SSV Quantitative Trading System

SSV system is designed to help investors make accurate decisions in complex market environments through an intelligent and data-driven approach, enhancing investment efficiency and returns.

About us

Intelligent Analysis System

Combining a number of technical indicators with HEC Capital’s original analytical methodology, we conduct a comprehensive assessment of fundamentals, technical aspects, capital flows and other dimensions to screen out high-quality investment targets with the highest potential for our users.

Real-time online warning

The platform has a built-in intelligent early warning system that alerts users to key changes in the market in a timely manner, including price movements, institutional position signals and important event triggers, so that you do not miss every important moment.

Enhancing Precision

Achieve over 90% accuracy in market forecasting.

Data processing and algorithms

SSV can handle more complex market data and make more accurate predictions

investment strategy

Continuously learn from user behavior and market changes to optimize investment accuracy.

Total Investment Management & Innovative Asset Insights

A full-service investment management platform that combines intelligent analytics, risk control and innovative asset insights.

Monitoring of financial flows

Including price movements, institutional position signals and important event triggers

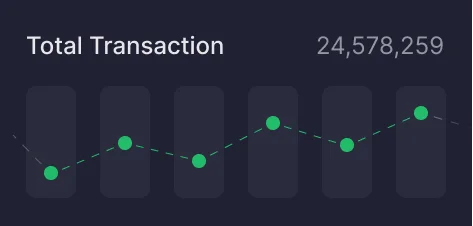

Data processing speed

Introducing more efficient cloud and edge computing technologies to ensure that the system can react quickly in high-frequency trading.

Real-time data and trend analysis

Real-time update of market information and in-depth analysis to ensure that users get the latest and most accurate market dynamics.

Decoding Every Swing in the Market

Combining a number of technical indicators with HEC Capital’s original analytical methodology

Real-time data

- SSV relies on leading global data sources for real-time market updates and in-depth analysis

Dynamic optimization

- Automatically adjusts strategies and optimizes portfolios based on market fluctuations and the user's investment objectives.

intellectualize

- Personalized recommendations of the most appropriate investment strategies based on changing market conditions and investment objectives.

Accurate stock picking, smart win in the future

The launch of SSV quantitative trading system marks a new era of intelligent investment management.

Drive investment with intelligence.

SSV offers smart, efficient and reliable investment solutions for every user.